Joint Declaration By the Member and The Employer. PF Joint Declaration Form PDF Download 2023. How to Fill a Joint Declaration EPF Form

Joint Declaration Form

Anyone is prone to make mistakes regardless of being careful or keen in filling out their documents. Sometimes one can miss a letter in their name or provide the wrong dates while filling out crucial documents. The EPF account is a significant feature in many Indian employees registered under the EPFO scheme. EPF allows workers to gain retirement benefits once they attain the set age. Eligible users can also request partial withdrawals based on exceptional cases.

However, to receive the PF amount employee’s details must match with proof document credentials.Any wrong information prevents the user from withdrawing funds, which requires legal authorization. Employees facing the data correction process need to fill out a joint declaration form to help rectify mistakes on their EPF.

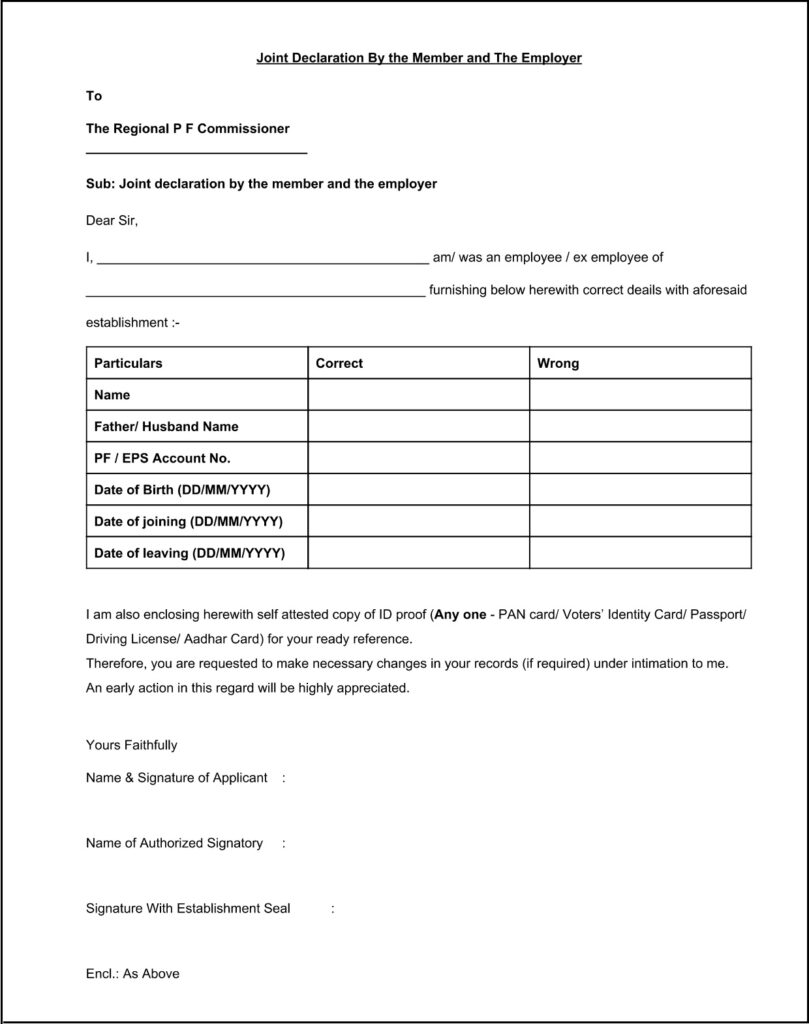

A Joint declaration form is a legal document used to correct provident fund (PF) member data. Suppose the EPF member’s date of birth or name has an error; they must use the EPF form or joint declaration form to correct the issue. The employee and employer must sign and submit the form to the regional PF commissioner’s office. The regional office officials will review the details and update the wrong information, providing the right details.

Joint Declaration Form PF

joint declaration by the member and the employer

Why Correct EPF Mistakes?

EPFO conducts the majority of PF services online via the EPFO or UAN portal. It’s challenging to log in or withdraw funds from a PF account with incorrect details. The system is set to recognize all members meaning no employee can log in without proper documentation. It’s advisable to check EPF details and make any updates regularly. The process is available on the member e-sewa portal. However, crucial data such as name and date of birth cannot be changed online but on the joint declaration form.

What Details Are Corrected Using the Joint Declaration EPF Form?

Registered EPF members can use the joint declaration form to make corrections on the following details:

- Applicant’s name

- Father or husband’s name

- PF and EPS account number

- Joining and leaving date

The EPF details should coincide with the Aadhaar card details. During account registration, employees should link their EPF account with their Aadhaar for easy transactions.

Required Details for Joint Declaration Form

EPF members seeking to correct their PF account details must present the following documents:

- Aadhaar card

- PAN card

- Voter’s ID

- Passport

- Driving license.

How to Fill a Joint Declaration EPF Form

An employee needs to address the Regional PF commissioner and enter the correct and wrong details. The form is physically submitted to the regional PF office, where the company is registered. Enter the correct name, father/husband’s name, PF/EPS account number, date of birth date of joining and leaving. Next, fill in the wrong details that need correction as stated on the form. Note the employee and employer or authorized signatory must sign the document before submitting it at the regional PF office.

Review the information and attach the required documents to support the claims. The user provides a self-attested address and identity-proof documents during form submission. The office will verify and approve the details, allowing the user to transfer PF funds or conduct any PF-related activities.

PF Joint Declaration Form PDF Download 2023

Joint Declaration Form in Word Format Download

FAQs

- Can I change my name on the member e-sewa portal?

Though members can change some EPF details online, one cannot change their name or date of birth online. Eligible members should fill a Joint declaration EPF form and submit to the regional PF commissioner.